Whether one wants to renovate the home , splurge on a marriage or go on a vacation, a personal loan is required to meet the financial needs. Institutions like banks and nowadays , Fintech companies offer many consumer loan options- be it structured or an instant loan.

Traditionally, a major chunk of our population still rely on banks as an option to get consumer loans. One takes a loan amount from the bank, repay it in some fixed period of time at an interest rate that could range from 8-15%, per annum. But if you have seen the experience of our parents, or even ours too, going through the procedure of procuring a loan from a bank is not always pleasant. You need to physically go to a bank, fill endless paperwork, attach documents like identity proof, income proof etc and require collateral too. After that the processing time of loan disbursement too sometimes takes days or weeks together.

In today’s fast paced life no one has the time to go through these unnecessary procedures, and a prudent choice would be to take a loan from a personal loan app. This is a digital age, and with the help of technology one can get things like groceries, furniture, clothes right at the doorstep. And joining the league, of late, is getting a personal loan through a loan app. The biggest advantage being convenience and fast disbursement of loan.

DIGITAL LENDING PLATFORM PLANET APP (Personalized Lending & Assisted NETworks) MAKES IT EASY FOR ALL:

PLANET APP, the official app of L&T Finance, a leading NBFC (Non-Banking Finance Company) registered under the Reserve Bank of India, 1934, is a one-stop shop to avail loans as well as keep a track of various loan details including Two-Wheeler Finance, Farm Equipment Finance, Micro Loans, Housing Finance, SME Finance, Farm Equipment Loans, and Consumer Loans.

When it comes to consumer loans , the PLANET APP has gained popularity in recent times due to their easy application process, flexible loan amount, and quick disbursal of loans (in as low as 7 minutes!!) and easy repayment terms. This means that users can apply for a loan and have it approved and get it quickly, without the need for extensive documentation or a lengthy approval process. Furthermore, the interface of the PLANET APP is built in a way that enhances the customer engagement and experience.

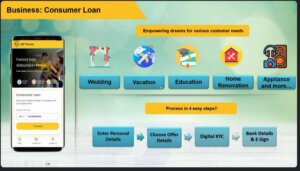

So whether one wants a loan for wedding, vacation, education, home renovation, appliance or other similar kinds , PLANET APP got it all covered.

Applying for a loan with Planet APP is easy and can be done in a few steps:–

- Download the Planet APP

- Fill out the application form with your personal/professional detail.

- Choose offer details

- Upload your essential KYC Documents

- Bank details and E-sign up

PLANET APP also offers multilingual support in 12 different languages for personalised experience!!

The app is geo-agnostic, making the journey easier for customers regardless of their location, and has also received a 4.4-star rating on the Google Play Store and a 4.3-star rating on the App Store for its downloads.

Other Key USPs of the PLANET APP:

- Convenient Loan Payment Options

- Easy Loan Documents Access

- Digital Two-Wheeler Loans

- Reminder for EMIs

- Easily Manage Personal Information

- Secure Transactions

- Credit Score Check and Wellness Insurance Plan

- Mandate Swap

- Mandi Price

Whether you are a first time borrower or an experienced one, navigating a traditional banking environment is not always a pleasant task. Alternatively, an online lending App makes it easy to manage finances and borrow money. So download PLANET APP today , because with it one need not be overly technical to navigate the financial system , plus it provides borrowers an easy, quick and cost effective loan option.

QR code to download the loan App:

Great to know that the loan application is processed within 7 minutes.

Got to know the details about this planet app & how seamlessly it works. I am interested in two wheeler loans.

PLANET App seems to be a state of the art app that brings consumer loans within easy reach. Nice to know that it cuts down the paperwork and documentation. Sandy N Vyjay